An important new report from the Boston College Law School Forum on Philanthropy and the Public Good shows how the failure to regulate donor-advised funds (DAFs) and private foundations has cost charities over $300 billion in foregone donations in 5 years alone. These are crucial funds that could have been used to feed the hungry or invest in local youth academic and enrichment programs.

While most of the reporting to date has focused on reports by DAF sponsors on payout rates, this study by Boston College law professor Ray Madoff and University of California at San Diego economics professor James Andreoni is the first to look to charities themselves to see how they have fared over the past thirty years. Among the report’s findings: there has been a substantial shift in giving toward private foundations and DAFs and away from direct giving to charities. In addition, even after taking into account the amount charities have received as grants from DAFs and private foundations, charities are still losing out.

This all matters because it underscores the problem that the tax code isn’t actually working for the nonprofits that it’s supposed to help. Outdated rules in the tax code allow funding promised to charities to remain warehoused in charitable intermediaries such as private foundations and DAFs.

Here are six charts from the report that demonstrate the problem with charitable giving laws:

1. There is no evidence that the explosion of DAFs has resulted in an increase in individual charitable giving. This chart shows that charitable giving by individuals has remained largely constant for the past 40 years, hovering at roughly 2% of disposable income.

.

2. While individual giving has remained largely constant, there has been a substantial shift in this giving toward private foundations and DAFs and away from direct giving to charities. In 2019, giving to DAFs and private foundations made up 28% of individual giving, a 460% increase compared to 1991, when the first commercial DAF began operating.

.

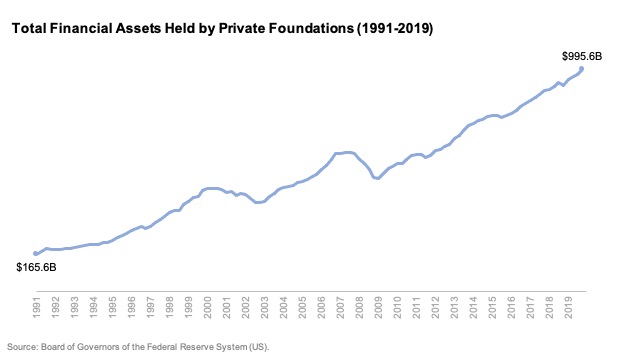

3. The value of assets in private foundations has skyrocketed over the past thirty years. Specifically, since 1991, nearly $1 trillion has been warehoused in private foundations, representing a 500% increase over the past 30 years.

.

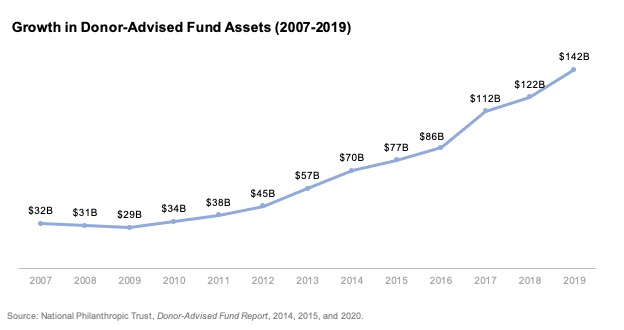

4. The value of assets in donor-advised funds has also exploded in the last thirty years. Over this short 12-year period from 2007-2019, total donor-advised fund assets grew over 300% – from $32 billion in 2007 to $142 billion in 2019.

.

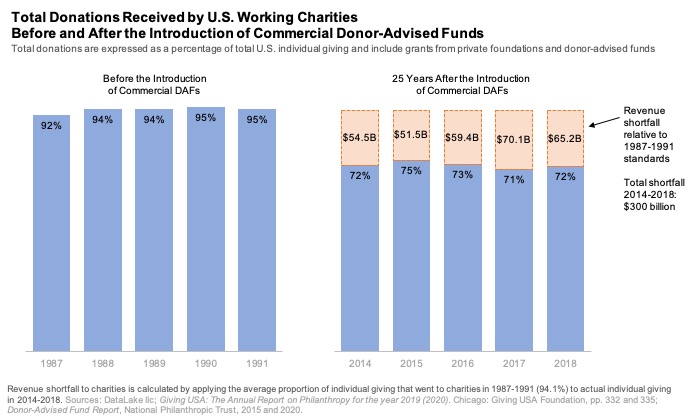

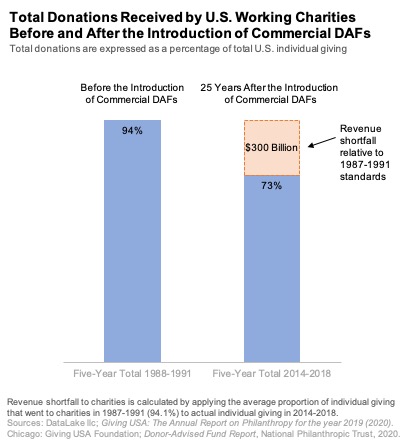

5. The rise of DAFs contributed to charities losing out on $300 billion in additional revenue from 2014-2018. As the charts below illustrate, if charities had received donations at the rate of 94.1% of individual giving (the average rate that they received in the 5-year period before commercial donor-advised funds), they would have received an additional $300 billion over those 5 years.

.

Charitable intermediaries have an important role to play in the charitable landscape, but it’s clear that the status quo is simply not working.

With more than $1 trillion dollars sitting on the sidelines in DAFs and private foundations, this novel analysis underscores the need to modernize our nation’s tax code to ensure charities – not charitable intermediaries – benefit. We must reform our nation’s charitable tax rules so charities can once again be the center of our charitable giving laws.

Read the full report here.